Hotels: Occupancy Rate Increased 2.1% Year-over-year

From STR: U.S. hotel results for week ending 11 May

Click on graph for larger image.

Click on graph for larger image.

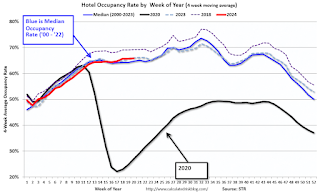

The red line is for 2024, black is 2020, blue is the median, and dashed light blue is for 2023. Dashed purple is for 2018, the record year for hotel occupancy.

The 4-week average of the occupancy rate is tracking last year, and slightly above the median rate for the period 2000 through 2023 (Blue).

Note: Y-axis doesn't start at zero to better show the seasonal change.

The 4-week average of the occupancy rate will move mostly sideways seasonally until the summer travel season.

The U.S. hotel industry reported higher performance from the previous week and positive comparisons year over year, according to CoStar’s latest data through 11 May. ...The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

5-11 May 2024 (percentage change from comparable week in 2023):

• Occupancy: 66.1% (+2.1%)

• Average daily rate (ADR): US$162.14 (+4.4%)

• Revenue per available room (RevPAR): US$107.24 (+6.6%)

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2024, black is 2020, blue is the median, and dashed light blue is for 2023. Dashed purple is for 2018, the record year for hotel occupancy.

The 4-week average of the occupancy rate is tracking last year, and slightly above the median rate for the period 2000 through 2023 (Blue).

Note: Y-axis doesn't start at zero to better show the seasonal change.

The 4-week average of the occupancy rate will move mostly sideways seasonally until the summer travel season.

Recent comments